Value Management Framework

“”We don’t have a pulse on what’s happening in our change-portfolio,” admitted the Managing Director of an Asset & Wealth Management company, his frustration palpable. I probed further, “Is it a problem with data, tools, or skills?” He sighed, “We have an army of people producing reports daily, drowning us in PowerPoint decks for monthly steering committees and quarterly board meetings.” Just as I was about to delve deeper, he interrupted, “That’s exactly what you need to uncover”.

- my conversations with the client

Managing Value – a complex challenge

The problem of poor or unsatisfactory strategic portfolio outcomes is a persistent issue to solve in many organisations. Despite years of experience, expertise bought from auditors & consultants and huge sums of money spent on sophisticated tools and technologies, the challenge remains unresolved.

On one hand, there is a push to produce more and more reports to meet the demands of different stakeholders across the hierarchy. On the other, there is a severe lack of high-quality data to support decision making and optimise the current state or plan for the future. Despite the abundance of data and reports in many organisations, and the availability of tools to generate and support them, there is a significant lack of agreement on what “value” means and there is a severe shortage of actionable intelligence to drive outcomes of transformation initiatives.

Compounding this, the process of gathering, cleaning, summarising, reporting, and acting upon the data is time-consuming and prone to errors, leading to “decision latency and poor dependency management” – two critical challenges that contribute to strategic programme failures across industries.

When the Managing Director mentioned being “drowned in PowerPoint decks,” he wasn’t just speaking for himself. Many organisations experience this data overload, producing numerous reports but deprived of the high-quality data needed for effective decision-making.

Digging deeper reveals that the challenge extends beyond data collection, reporting, or bureaucratic governance. The following simplified causal loop diagram illustrates the complex issues organisations face in managing the value of their project-portfolio investments.

Remember the Managing Director’s initial comment?—”We don’t have a pulse on what’s happening in our change-portfolio.” The challenges outlined above in the picture explain why. This is a complex problem, where it is difficult to establish exact cause and effect relationships, where everything seems muddled and foggy, losing the pulse.

But it doesn’t have to be this way.

Addressing the “wicked” problem

Addressing this wicked problem requires carefully applying multiple solutions and continuously monitoring the progress in desired direction.

There is no shortage of models, methods, methodologies, frameworks, and tools (see Appendix 1) designed to tackle the challenges of Value Management from various perspectives. The Balanced Scorecard, for instance, encourages us to go beyond financial indicators by including customer perspectives, internal business processes, and learning & growth metrics. Similarly, the EFQM Model provides a framework for organisational management focused on achieving excellence through customer, employee, and societal value. The World Economic Forum’s International Business Council (WEF IBC) identified a universal set of metrics to help businesses better demonstrate their contributions toward sustainable, long-term value creation

Yet, value management is hard and elusive in many large organisations. This created a need for a holistic framework that is robust enough in addressing the complex challenges mentioned above, but at the same time clear and simple enough to implement with practical solutions suitable for common contexts in large organisations, especially for those undergoing technology enabled transformation. This is how I see the framework’s end goal:

This framework shall enable us “define what we value as a business (Sources of value) from multiple stakeholders’ “perspectives” across multiple “dimensions” of value with clear indication on the “purpose(s)” of tracking & measurement across a “value lifecycle” appropriate for the organisation or endeavour at hand”.

Let’s now unpack the solution I suggested above:

Sources of Value: At the core of an organisation’s economic-engine lies its sources of value, which are embedded in the organisation’s strategy and its offerings (propositions, products, services etc.) to the intended users. These sources reflect the unique capabilities, assets, or positions that an organisation leverages to generate economic benefits and stakeholder value. For example, a high street bank derives value primarily from the financial products it offers, such as savings accounts which attract capital and loans that generate interest revenue. Beyond these traditional sources, a bank might also find value in its customer relationships, brand reputation, technological innovation, and operational efficiency. Each of these components serves as a wellspring from which the bank can draw to sustain and grow its market presence. Typical sources of value would look like:

| Category 1 | Category 2 |

|---|---|

| Growth Efficiency Resilience Risk Reduction Reputation Etc. |

The same can be found in Strategic Objectives of an organisation like the below for Lloyds Banking Group, UK

|

Metrics and Measurement: These sources of value are measured through various metrics. For a typical Bank, few metrics they measure could include “savings or mortgage balance, cost-income ratios, number of complaints, number of customer service calls” etc. There will be hundreds of such metrics you’d find in any organisation.

Perspectives of Value: (Business) Value is contextual. Value in an organisation is multifaceted and perceived differently across various levels and stakeholders. For example, C-Level Executive may prioritise strategic alignment and long-term returns, whereas Change Delivery Leads may focus on project feasibility, efficiency, and delivery within budget and time constraints. Sometimes, improving on one metric could adversely affect other critical metric, for example: increasing mortgages balance could be achieved at the expense of taking more risk. Recognising these diverse perspectives is crucial for holistic value management. It ensures that the organisation’s strategies and actions resonate with all stakeholders, aligning with their unique priorities and expectations. Typical perspectives you need to consider in an organisation are:

| Category 1 | Category 2 |

|---|---|

| C-level executives Functional or Regional Heads Change Delivery Leads Support Functions (e.g. Finance, Risk, Legal, Compliance etc.) Social Pressure Groups Etc |

ExCo / Board Portfolio Management Committee Performance Review committee Risk Review Committee Etc. |

Dimensions of Value: The dimensions of a value are aspects of an organisation or programme or portfolio that are being evaluated. These dimensions are used to assess the effectiveness and success of the organisation or programme or portfolio. Organisations typically measure “financial” dimension of value. But this is not the only dimension that portfolio investments contribute to. Balanced Scorecard broadened these dimensions that many organisations are using for quite some time. Along with these, there are multiple categories of dimensions that organisations shall use. Table below summarises few such categories:

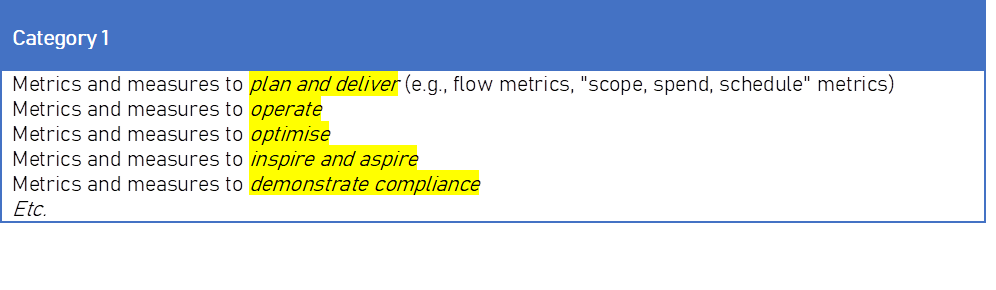

Purpose of Value Measurement: In Value Management, understanding the Purposes of Value Measurement is crucial. It defines the “why” behind the measurement process, directly impacting the “what” and “how” of data collection, analysis, and utilisation. An example from Agile-camps is “Team Velocity”. Though it is useful for team members, it is not meant to be used to compare how different teams are performing. Quite often, it is detrimental to change the purpose of measurement when making decisions. So, the “purposes of value measurement” help us determine what metrics and KPIs are being measured, how the data is being collected and analysed, and how the insights are being used. Typical purposes include:

Value Lifecycle: Known by many names like “concept to cash and idea to impact”, a value lifecycle defines the stages within which an organisation manages and optimises the value it intends to create. The value lifecycle represents an organisation’s journey from the initial idea to its ultimate impact on the market and financial books, often spanning years in large organisations. Typical lifecycle stages are “Value Identification, Value Creation, Value Release and Value Realisation”. In many organisations, these are seen as “Strategic / Corporate Planning, Business & IT Solution Delivery, Operational Change, IT Operations & Business Operations (usually known as BAU, Run activities) etc.”.

| Value Identification | Value Creation | Value Release | Value Realisation |

|---|---|---|---|

| At this phase, value is recognised and defined. Ideas are generated, opportunities (propositions) are assessed, and potential value streams are identified, often through strategic foresight and market analysis | In this phase, the organisation mobilises resources to transform identified value opportunities (propositions) into tangible outcomes. This is where strategy is translated into actionable plans and where product development or service refinement takes place | Here, created value is deployed to the intended audience or market. It marks the transition from internal development to external availability, such as launching a new product, service, or business model | The final stage where the organisation measures and collects the returns on its value-creating efforts. This could manifest as increased revenue, market share growth, or enhanced customer satisfaction and loyalty. |

Contact Us

Want to learn more or discuss how these insights apply to your organisation?

Get in Touch